News

Compound interest is an investor’s best friend but can be a borrower’s worst nightmare.

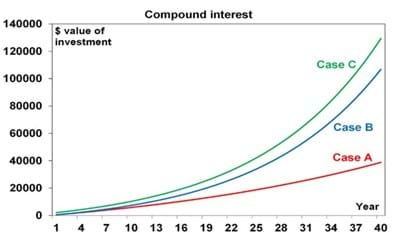

The higher the return, the earlier and bigger the investment contribution and the longer the period the more it works.

To make the most of it, ensure an adequate exposure to growth assets, contribute early & often to your investment portfolio and turn down the noise around investing.

Earlier this year, I was nearly caught out by a scam involving a fake payroll request. It looked legitimate, and it came at a busy moment—exactly when I was least expecting it. Thankfully, I paused, double-checked, and avoided what could have been a costly mistake.

A growing number of young Australians are banking on a financial windfall from their parents and grandparents, but new research suggests many may be overestimating what they will receive.

Clients and advisers from across the region gathered for the annual joint financial event co-hosted by Isla Grey Financial Advice, Thompson Wealth, and Phillips Wealth Partners. The event aimed to provide education and insights into the current economic climate, behavioural finance, and retirement planning strategies.

Loneliness Awareness Week—held nationally in the first week of August—is a vital time to acknowledge those in retirement villages who may be feeling isolated, even within a community setting. Known also as “Loneliness Awareness Week in Australia,” it shines a spotlight on the importance of connection for all Australians, including older adults.

Australian superannuation funds are breathing a sigh of relief after the US dropped a so-called “revenge tax” on foreign investors.

A suite of significant changes impacting wages, superannuation, energy costs, and business regulation came into effect from July 1, marking a new financial landscape for Australian households and businesses. These updates, announced by various government bodies, are expected to influence budgeting, planning, and investment decisions across the country.

As the new financial year begins, many Australians are reviewing their finances and preparing documents for their accountants. Among the paperwork, one question often arises: Are financial advice fees tax-deductible?

At a recent Retirement Village Residents Association (RVRA) ACT event, I was struck by a powerful reminder from Di Johnstone, General Manager of Pets and Positive Ageing Inc.: when planning for retirement, aged care, or end-of-life matters, pet owners must also plan for their animals. Our pets are family, and just like any loved one, they deserve a secure future.

The Reserve Bank of Australia (RBA) has reduced the official cash rate to 3.85%, marking the second rate cut this year and the first time the rate has fallen below 4% since 2023.

National Volunteer Week (19–25 May 2025) is Australia’s largest annual celebration of volunteering—and a special moment to recognise the everyday heroes who give their time, energy, and compassion to others.

We recently held a free community workshop in Canberra hosted by KJB Law and Phillips Wealth Partners, helping attendees prepare for two major life planning priorities: aged care and estate planning. If you weren’t able to attend — or if you’d like a refresher on what was covered — you can now access the main sessions online.