Our frailty years

Planning your retirement is likely to be exciting. While it may be less fun to think about the potential for physical and cognitive decline in the later part of retirement – our frailty years - this is an important period to plan for if we want to maintain independence for as long as possible.

The reality is that we are all likely to experience some cognitive decline or lose some of our physical ability as we age. This is a natural process but does not mean we will all develop dementia or lose the ability to live independently.

It does mean however, that at some point we may need to ask for help with our normal activities of daily living. This might be help we access in our own home. Or we might need to move into residential care for a higher level of support.

What should I plan for?

Figures from the Australian Institute of Health and Welfare estimate that on average approximately 17-25% of your retirement years could be “frailty years”.

|

|

Example: If you expect a potential of 30 years in retirement, on average the frailty years would represent 5-7 years. Planning for this length of time and planning early enough might help you to have the resources to pay for care and prevent leaving the planning until crisis point. |

If asked, most of us would prefer to stay in our own homes as we age. Staying at home may be possible if we have lower care needs or we can rely on the support of a capable spouse/family or if we have sufficient financial resources to pay for help at home.

But if our care needs are too high for the people around us to cope, or we don’t have support networks, residential care might be a better option.

In any case, planning the financial aspects of your retirement should also include an estimate of how much you might need to pay for care. This is difficult to calculate because of the unknown factors around health, opportunities and finances.

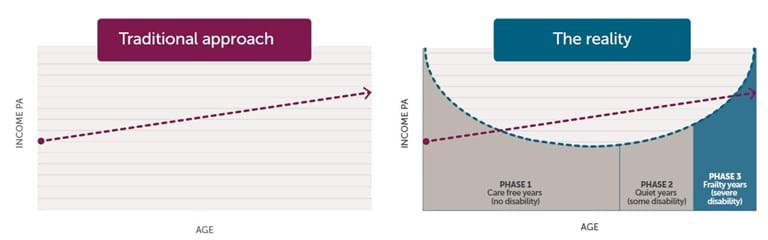

Historically, the approach to retirement planning has been to decide what income you need and then calculate how much you need to save to generate this income. Most people assume a flat (or declining) level of income which grows with inflation. However, if you consider the cost of care, the pattern is more likely to follow an upwards curve as shown in the graph below.

In your early retirement years, you may spend more on leisure activities. This spending may decline as you age but is likely to be replaced with the costs of care or to pay someone to do the activities you used to do yourself.

What does care cost?

The costs of aged care have been increasing and opportunities expanding. The government is increasingly focussed on helping to expand and improve the home care opportunities

Australia has a good system of care compared to many other countries, with safety nets to ensure people with lower financial capabilities can access care. But the ability to choose and the options available may be more limited if relying on the low-means concessions.

How much you will need to pay can be difficult to predict. Currently, it can roughly vary from $100 a week to $6,000 a week depending on the options chosen. This covers the wide-range of opportunities from basic home care packages to full-time nursing care at home.

Access to government subsidies and rules for calculating the fees based on your finances helps to make care affordable, but having adequate savings opens up your choices and your ability to control the level and type of care you receive.

|

|

Home care packages |

Residential care |

|

What you might pay |

$3,767 - $14,553 per year* |

$18,308 - $45,273 per year* |

|

What government might pay |

Up to $50,286 per year |

Up to $90,794 per year |

*Additional service fees may also apply if selected and agreed with the service provider

These figures are current to 19 September 2018 and only cover the cost of care. Regardless of which option you choose you also have the costs of accommodation and other personal expenses.

What should I start thinking about?

While you don’t know what your future holds, with some planning you can help to make your retirement a comfortable one and live it the way you choose.

Some of the things you can start to do include:

- Ensure you have a safe and secure income in place for life – this might be pension income, lifetime income streams or drawdown strategies from other investments.

- Include your home as a financial resource available to provide a safe place to live – this might be a physical building but it might also be access to equity to pay for care needs by drawing regular income under an equity release arrangement or renting to generate extra income if you move into residential care or selling to access the sale proceeds for other purposes.

- Consider the impact you would have on family and friends if relying on them to provide care and how you can help with financial support.

Planning to make sure you have resources available is important. Equally important is to ensure you have an Enduring Power of Attorney in place in case someone else needs to take on the responsibility of making the decisions and paying the bills on your behalf.

How do I get help?

We are specialising in aged care advice and matters to help provide our clients with a full retirement planning service. Ask us today for how we can help you plan for a secure and comfortable retirement throughout all phases of your retirement – including the frailty years.

[1] AIHW 2017 report Life expectancy and disability in Australia: expected years living with and without disability, based on expectancies of a 65-year-old.