Australia Faces Trade War Headwinds – But Recession Still Unlikely, Says AMP Economist

"The risk is high, and Australia may not see the pickup in growth to around 2-2.5% or so this year that many including ourselves had been forecasting. But Australia should be able to avoid a recession in the face of Trump’s trade shock". Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP

The trade tensions triggered by President Trump’s escalating tariff war are rattling markets, sparking fears of a global downturn and raising concerns about Australia’s economic resilience. But according to AMP’s Head of Investment Strategy and Chief Economist, Dr Shane Oliver, Australia still has a good shot at dodging a recession.

“While we’re not immune to a global slowdown, there are a few key buffers in place that should help cushion the blow,” says Dr Oliver. “A falling dollar, room to cut interest rates, and a pre-election spend-a-thon all help tilt the odds in our favour.”

Global Risks Loom, But Australia Isn’t the Main Target

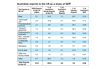

Much of the anxiety stems from the broader economic drag that a prolonged trade war can cause. Although only about 5% of Australian exports head to the United States, slower global growth could hit demand for Australian goods, especially resources.

“The bigger issue is not the direct impact of US tariffs on us – that’s relatively small,” says Dr Oliver. “It’s the indirect hit from weaker global growth, especially out of China, that could bite.”

Still, he points out that while the risk of a US recession is climbing – possibly as high as 45% – the global economy overall looks more likely to slow than to crash. That matters, because Australia’s exposure is more to the global trade system than just the US.

The Aussie Dollar as a Pressure Valve

One of Australia’s key defences? The Australian dollar. As it weakens, Australian exports become more competitive and less vulnerable to price drops in US-dollar-denominated commodities.

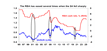

“Historically, when the Aussie dollar has fallen during global downturns – like during the GFC or the early pandemic – it has helped stabilise our economy,” Oliver explains. “This time, the dollar has already fallen around 14% from its highs, and that gives us a bit of a cushion.”

It also softens the blow for superannuation funds and investors with overseas holdings, provided they haven’t hedged their currency exposure.

Not All Trade Hits Home

While the 10% tariff on some Australian exports may sound alarming, the direct impact is likely to be limited.

“Only around 5% of our exports go to the US – that’s less than 1% of GDP,” Oliver says. “And many of the goods affected, like gold and beef, are fungible – they’ll likely find other markets.”

RBA Still Has Room to Move

Unlike the US Federal Reserve, which is juggling inflation fears, the Reserve Bank of Australia has more flexibility. With a cash rate still at 4.1%, there’s room to cut.

“We expect a rate cut in May – probably 0.25%, but maybe 0.5% if things worsen,” says Oliver. “And we’ll likely see more into early next year.”

Emergency action isn’t warranted just yet, he adds. “Financial markets are working fine. The banking system is strong. No need to panic.”

A Bit of Help From Canberra

With the election just weeks away, both major parties are throwing spending promises and tax rebates at voters. While not ideal from a long-term budget perspective, it does amount to a short-term stimulus.

“There’s a lot of money being promised to voters right now,” Oliver says. “It’s not the most disciplined economic policy, but it will support household spending in the short term.”

Is Trump Blinking?

After months of ramping up pressure, President Trump seems to be easing back – slightly.

“Trump’s reasons for the tariffs have always been a moving target,” says Oliver. “Now we’re seeing some exemptions, and that may reflect growing pressure from businesses and rising US bond yields – a sign that global investors are getting nervous.”

That matters because the US needs to keep borrowing to fund its ballooning deficit and debt. Higher yields make that harder.

“Trump might be getting a bit ‘yippy’ – his word – and backing away,” Oliver notes. “It’s not over yet, but it’s a sign that the worst-case scenarios might be starting to ease.”

The Bottom Line

While the road ahead may be bumpy, Dr Oliver remains cautiously optimistic.

“Yes, we’re exposed to global risks,” he says. “But we’ve got the buffers: a flexible currency, an active central bank, and a bit of help from the government budget. It’s not all smooth sailing, but we’re better placed than many.”